With less owners, fractional ownership homes undergo less physical wear and tear. Interior of a Timbers Fractional Resort. To acquire a timeshare, the minimum certifying home income has to do with $75,000. The minimum income for fractional homes is roughly $150,000. For private house clubs (a more luxurious fractional), minimum qualifying home earnings has to do with $250,000.

Home types are various too, with timeshares usually one or two-bedroom units while fractional tend to be larger homes with 3 to 5 bedrooms. Most fractional homes have a much better area within a resort, superior building and construction, greater quality furnishings, components, and devices in addition to more features and services than most timeshares.

Top quality construction and finishes, more resources for maintenance and management, and fewer users contribute to the residential or commercial property's appearance and smooth operation - how to get rid of timeshare without ruining credit. Fractional owners can usually exchange their holiday time to a new location, quickly and cheaply, on sites such as. By contrast, numerous timeshare residential or commercial properties break down gradually, making them less desirable for original buyers and less valuable as a resale.

Excitement About What Happens If I Stop Paying My Timeshare

In the 1960s and 1970s timeshares in the United States got a bad track record due to developer guarantees that might not be provided and high-pressure sales methods that discouraged many possible buyers. In action to buyer complaints, state legislators passed strict timeshare compliance disclosure and other consumer-protection regulations. Also, the American Resort Development Association (ARDA), adopted a code of business principles for its members.

They legitimized timeshares by enhancing the quality of the timeshare buying experience offering it trustworthiness. In spite of these efforts, however, the timeshare has not totally lost its preconception. Fractional ownership, on the other hand, has developed a track record as a dependable investment. In the United States, fractional ownership started in the 1980s.

By 2000, national luxury hotel companies Ritz-Carleton and Four Seasons, along with others, began offering properties, even more enhancing the image and worth of fractional ownership. During the very same duration, the fractional ownership idea reached other industries. Jet and luxury yacht industries ran successful ad campaign encouraging consumers of the advantages of purchasing super-luxury belongings with shared ownership.

A Biased View of How To Get Out Of A Bluegreen Timeshare

The purchase of a timeshare system is in some cases compared to the purchase of a vehicle. The cars and truck's value diminishes the minute it is repelled the display room floor. Likewise, timeshares, begin the depreciation process as quickly as they are purchased and do not hold their initial value. Much of this loss is due to the significant marketing and sales costs sustained in selling a single property system to 52 purchasers (how to get rid of your timeshare).

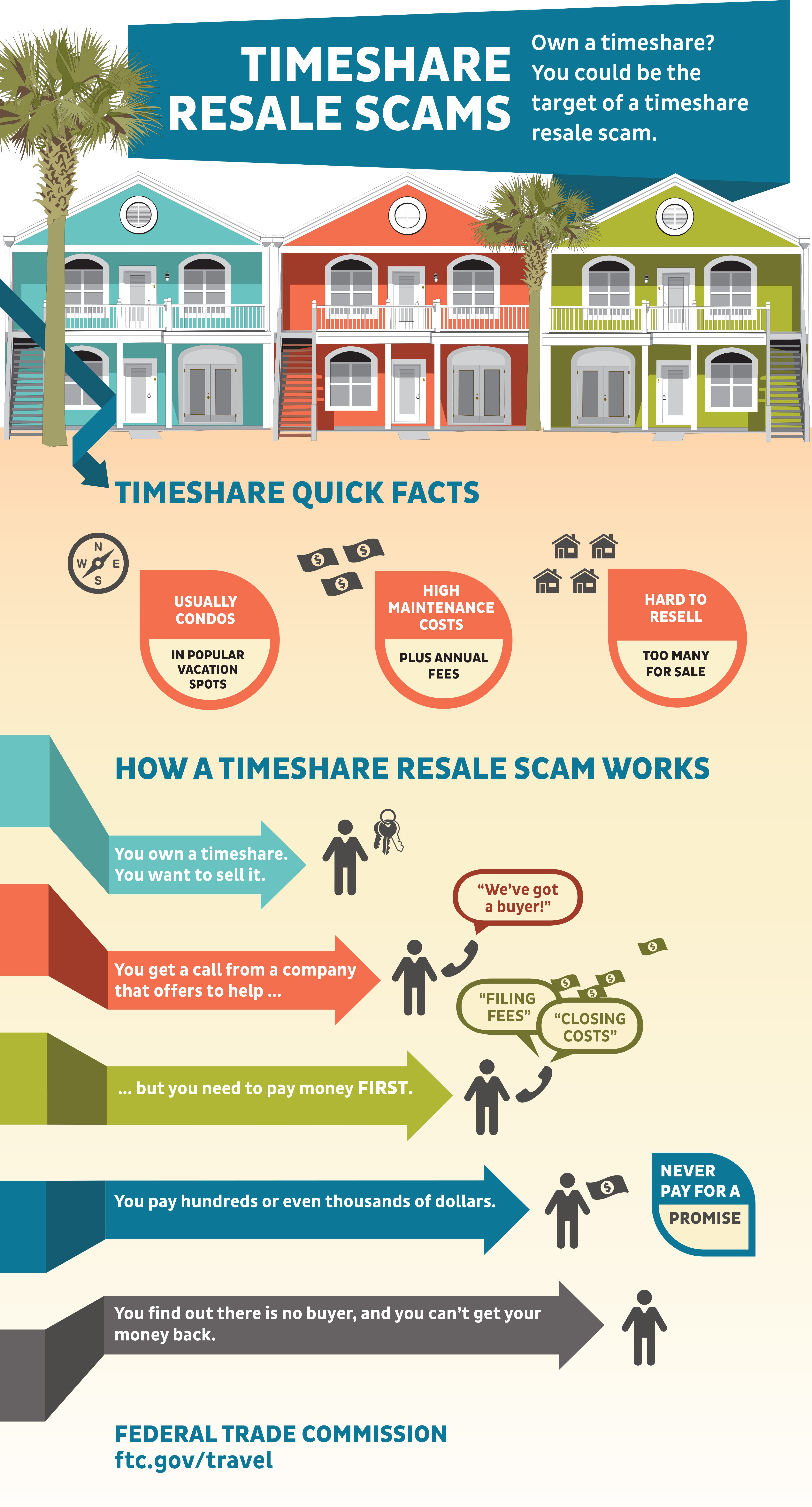

When timeshare owners attempt to resell, the marketing and sales expenses do not translate on the open market into property value. In addition, the competition for timeshare buyers is extreme. Sellers need to not just take on large varieties of similar timeshares on the marketplace for resale but should contend for buyers taking a look at brand-new products on the marketplace.

Statistics reveal that fractional ownership home resales rival sales of whole ownership holiday real estate in the exact same place. In some circumstances, fractional resale worths have even surpassed those of whole ownership homes. 2-12 owners Usually 52 owners, 26 owners for some tasks Fractional owners have a higher monetary commitment and are ready to pay greater expenses 4-8 weeks depending on the variety of owners One week per year Fractionals have less wear and tear with fewer residents Owners have a share of the title, based upon the number of owners.

How To Buy A Timeshare Fundamentals Explained

Fractional ownership in an investment Owners have great control over home management Project designer or hotel operator preserves management control Fractional owners are ready to pay greater management expenditures Owners pay maintenance costs and taxes on the residential or commercial property Upkeep expenditures and taxes are paid in regular monthly fees Timeshare owners need to anticipate regular monthly charges to increase every year Resale worth tends to appreciate Resale is tough even at reduced prices Intense competition for timeshare resales from other units and brand-new advancements Owners choose Very little service provided Private home clubs are a kind of fractional with numerous amenities Higher quality and bigger villa Usually one or two-bedroom units with fundamental quality Owners of fractionals have an incentive to maintain the home in excellent condition $150,000 yearly earnings min.

$ 250 yearly income minimum for private residence clubs A less pricey alternative to whole ownership of a villa A budget friendly alternative to hotels for holiday Buyer must decide which type is finest based upon objectives for the property Prior to choosing to take part ownership in a getaway house, evaluate the resemblances and differences between a timeshare and a fractional ownership.

Timeshare is the principle of multiple celebrations timeshare new orleans cancellation collectively owning a possession and the usage of that asset being shared among the owners by allowance of time slots. In travel, Timeshare most frequently refers to vacation accommodation generally divided into "weeks" of time and owned collectively by holidaymakers. Timeshare is frequently also referred to as "Holiday Ownership" and often "Fractional Ownership".

About What Is Timeshare Hotel

Ownership within a timeshare lodging can be assigned through a partial ownership, lease or a "ideal to own" basis where the allocation of a timeshare "week" is divided into the 52 week timeshare calendar which runs practically in tandem with the basic yearly calendar. Use rights of a timeshare property generally occur each year but can also occur on a bi-annual basis.

Timesharing came about in the early 1960's as a result of holiday home sharing where four European families would each buy into a collectively owned holiday home to share (how to purchase a timeshare). They would divide the usage over each of the four seasons and rotate yearly to make sure that each part-owner would benefit from each seperate season similarly.

Timeshare ownership on a week basis has its origins back in France and Switzerland where the very first trip ownership plans were developed by the French (Socit des Grands Travaux de Marseille) and Swiss (Hapimag) travel companies in 1963 and 1964 respectively. A year later on the concept of timesharing reached the USA with the Hilton Hale Kaanapali offering timeshared vacation ownership at the Pioneer Mill Plantation on Maui, Hawaii in 1965.

Not known Factual Statements About How To Get Out Of A Timeshare Ownership get more info

Exchange companies now use over 7000 resorts worldwide. Timesharing grew enormously in the boom years of the 1980's and resulted in the increasing variety of resorts and brands operating worldwide today. The 1990's saw the introduction of huge name brands such as: Marriott, Sheraton and Hilton get in the timeshare market adding big, trusted names to the timeshare market and they still operate around the world today.

e. "Week 14" which would normally tend to fall as the very first week in April. The timeshare owner would be given the unique right to occupy that particular week at the particular resort in which the particular timeshare accommodation unit lay. There is no fixed week period associated with this type of ownership but instead the owner can utilize a designated length of time (generally 7 nights) within a particular period of the year.